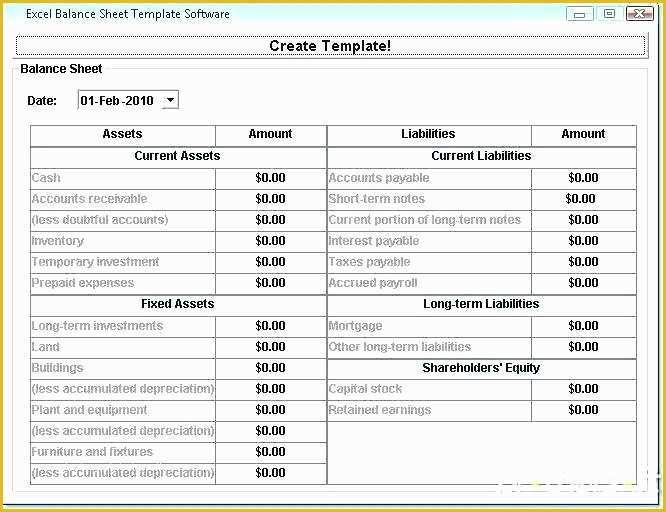

Balance Sheet Prepaid Expenses - As the benefits of the expenses are. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. While prepaid expenses are initially.

Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. While prepaid expenses are initially. As the benefits of the expenses are.

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. While prepaid expenses are initially. As the benefits of the expenses are. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. While prepaid expenses are initially. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Prepaid expenses and accrued expenses are.

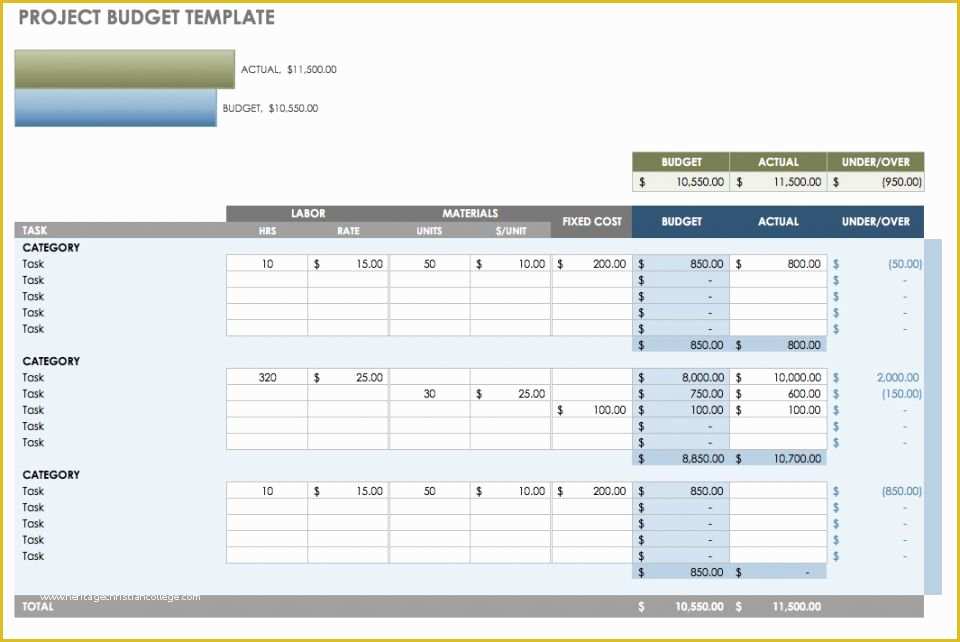

Prepaid Expense Template

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. While prepaid expenses are initially. As the.

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

As the benefits of the expenses are. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. While prepaid expenses are initially. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. The “prepaid expenses” line item is recorded in the current assets.

Prepaid Expense Reconciliation Template Excel

Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. As the benefits of the expenses are. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. While prepaid expenses are initially. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over.

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. While prepaid expenses are initially. As the benefits of the expenses are. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over.

Prepaid expenses on balance sheet leadersfas

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. As the benefits of the expenses are. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Prepaid expenses and accrued.

Free Prepaid Expense Schedule Excel Template Of Balance Sheet Template

While prepaid expenses are initially. As the benefits of the expenses are. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. The “prepaid expenses” line item is recorded in the current assets.

Free Prepaid Expense Schedule Excel Template Web Prepayments And

Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. While prepaid expenses are initially. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The.

Prepaid Schedule Template

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. While prepaid expenses are initially. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. As the benefits of the expenses are. The “prepaid expenses” line item is recorded in the current.

Free Prepaid Expense Schedule Excel Template Of Balance Sheet Template

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. While prepaid expenses are initially. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. Prepaid expenses and accrued expenses are.

While Prepaid Expenses Are Initially.

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. Prepaid expenses and accrued expenses are the two categories of expenses that constitute expenses paid over (or under) the amount that. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset.