Deferred Income In Balance Sheet - Also called unearned revenue, it appears as a liability on a. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. With a fresh angle, a clear example, and. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Deferred revenue, often perceived as a complex topic in financial accounting, plays a critical role in accurate revenue recognition and balance sheet management.

In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue, often perceived as a complex topic in financial accounting, plays a critical role in accurate revenue recognition and balance sheet management. Also called unearned revenue, it appears as a liability on a. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. With a fresh angle, a clear example, and.

With a fresh angle, a clear example, and. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Also called unearned revenue, it appears as a liability on a. Deferred revenue, often perceived as a complex topic in financial accounting, plays a critical role in accurate revenue recognition and balance sheet management. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed.

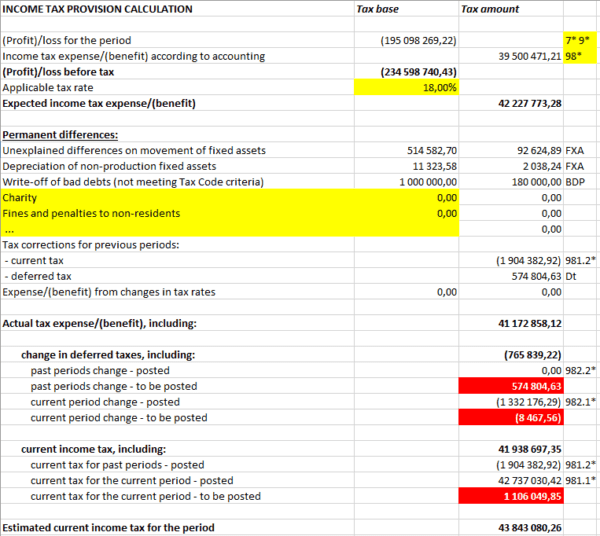

Current and deferred tax review and internal control methodology

In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. With a fresh angle, a clear example, and. In simpler terms, a deferred revenue journal.

Impressive Deferred Tax In P&l What Are The Operating Expenses

With a fresh angle, a clear example, and. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue (also called unearned revenue) is.

41 Balance Sheet Deferred Tax Expense

In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Also called unearned revenue, it appears as a liability on a. In this article, we’ll.

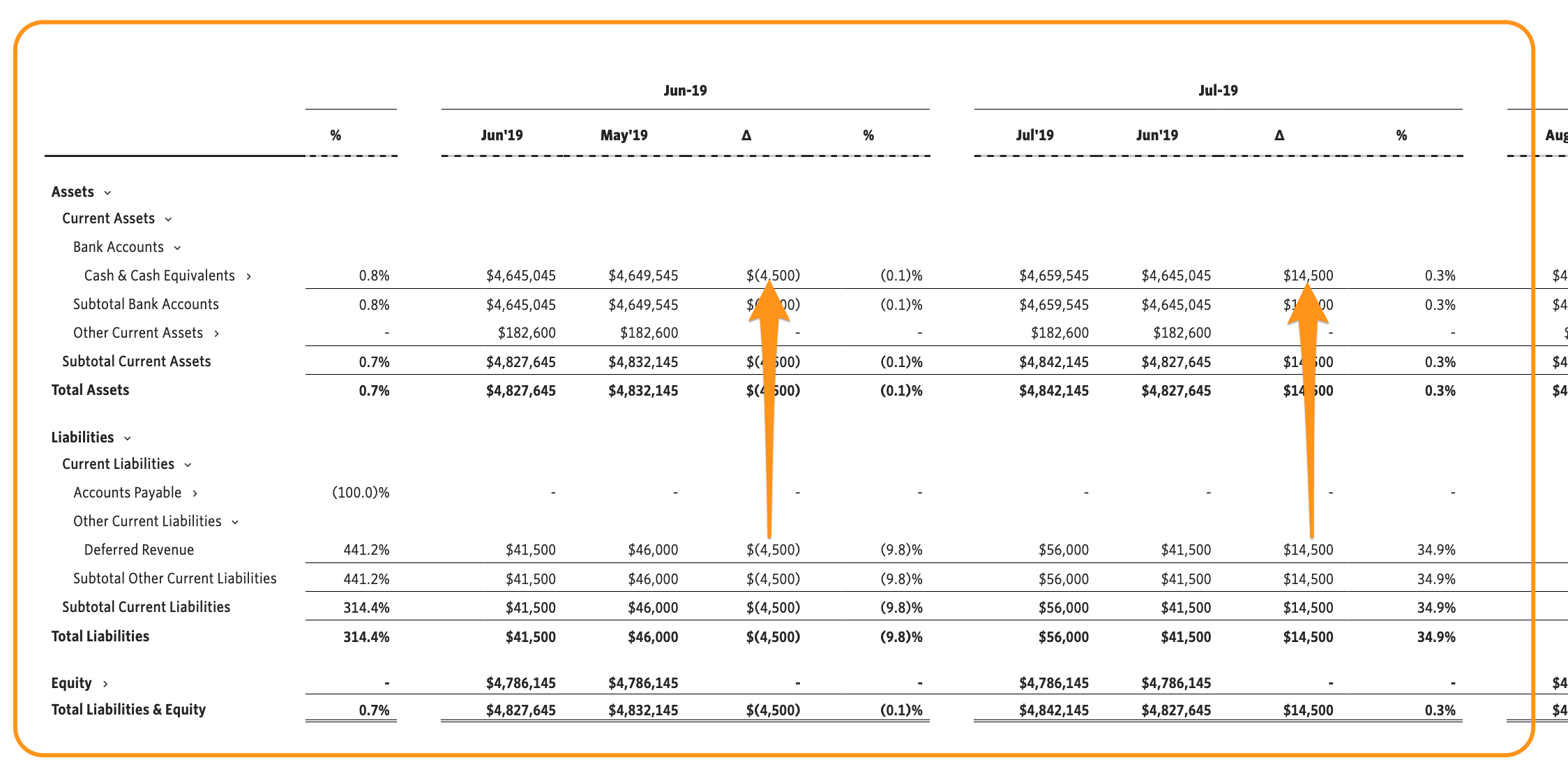

What Is Deferred Revenue? Complete Guide Pareto Labs

Also called unearned revenue, it appears as a liability on a. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than.

Deferred Revenue Debit or Credit and its Flow Through the Financials

In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Also called unearned revenue, it appears as a liability on a. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. In simpler terms, a.

Simple Deferred Revenue with Jirav Pro

With a fresh angle, a clear example, and. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. Also called unearned revenue, it appears as a liability on a. Deferred revenue is a payment a company receives in advance for products or services it has not.

Deferred Revenue Accounting, Definition, Example

With a fresh angle, a clear example, and. Deferred revenue, often perceived as a complex topic in financial accounting, plays a critical role in accurate revenue recognition and balance sheet management. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. Deferred revenue is a payment.

Deferred Tax Liabilities Explained (with RealLife Example in a

With a fresh angle, a clear example, and. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue, often perceived as a complex.

What is Deferred Revenue? The Ultimate Guide (2022)

Also called unearned revenue, it appears as a liability on a. With a fresh angle, a clear example, and. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Deferred revenue is a payment a company receives in advance for products or services it.

Deferred Tax Liabilities Explained (with RealLife Example in a

In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. In this article, we’ll explore what deferred income is, how.

Deferred Revenue Is A Payment A Company Receives In Advance For Products Or Services It Has Not Yet Delivered.

In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Also called unearned revenue, it appears as a liability on a. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed.

With A Fresh Angle, A Clear Example, And.

Deferred revenue, often perceived as a complex topic in financial accounting, plays a critical role in accurate revenue recognition and balance sheet management.