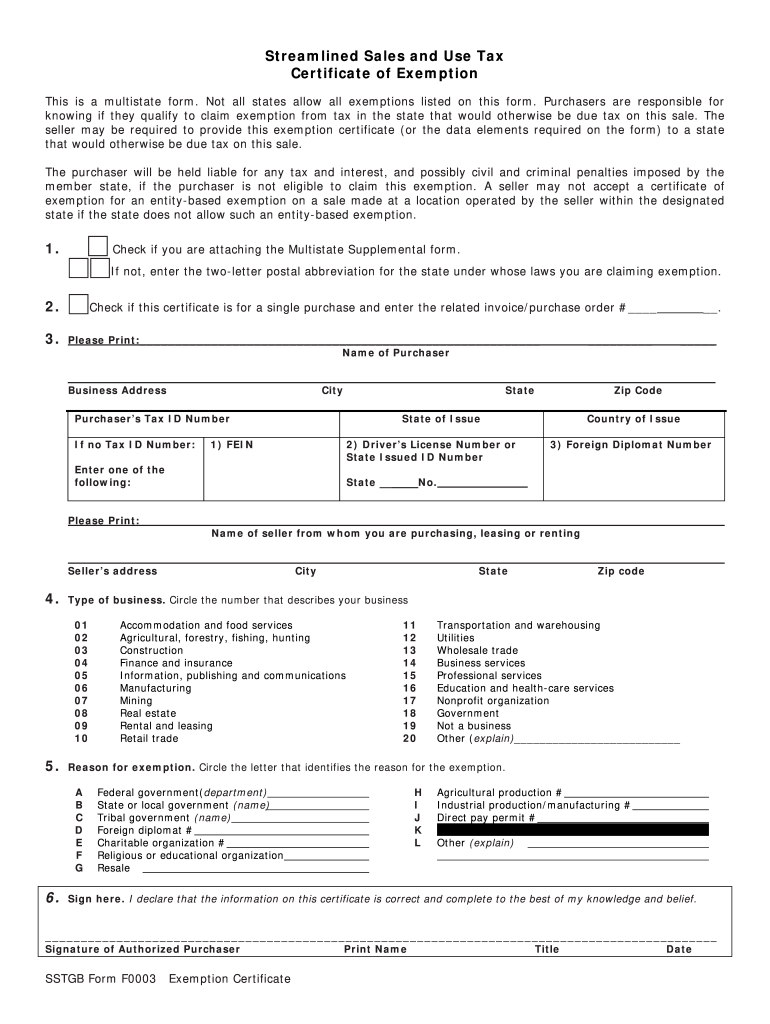

Tennessee Sales Tax Exempt Form - To understand the scope of exemptions and reduced rates, the purchases that remain. Sellers may continue to accept this paper form to document exempt sales to the. Application for broadband infrastructure sales and use tax exemption;. Provide the id number to claim exemption from sales tax that is required by the taxing state. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. The sales tax resale exemption is allowed for dealers purchasing items or taxable.

Provide the id number to claim exemption from sales tax that is required by the taxing state. The sales tax resale exemption is allowed for dealers purchasing items or taxable. To understand the scope of exemptions and reduced rates, the purchases that remain. Sellers may continue to accept this paper form to document exempt sales to the. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. Application for broadband infrastructure sales and use tax exemption;.

Provide the id number to claim exemption from sales tax that is required by the taxing state. Application for broadband infrastructure sales and use tax exemption;. To understand the scope of exemptions and reduced rates, the purchases that remain. Sellers may continue to accept this paper form to document exempt sales to the. The sales tax resale exemption is allowed for dealers purchasing items or taxable. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural.

State Sales Tax Exemption Form Tn

Application for broadband infrastructure sales and use tax exemption;. To understand the scope of exemptions and reduced rates, the purchases that remain. Provide the id number to claim exemption from sales tax that is required by the taxing state. The sales tax resale exemption is allowed for dealers purchasing items or taxable. Every fourth year, the tennessee department of revenue.

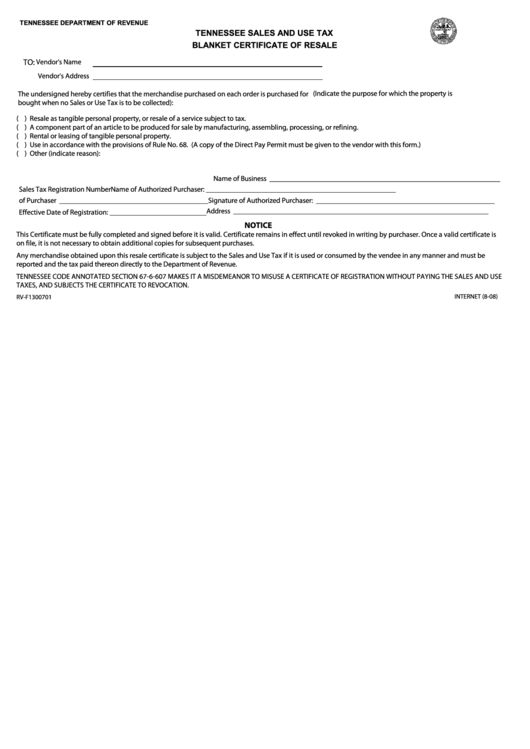

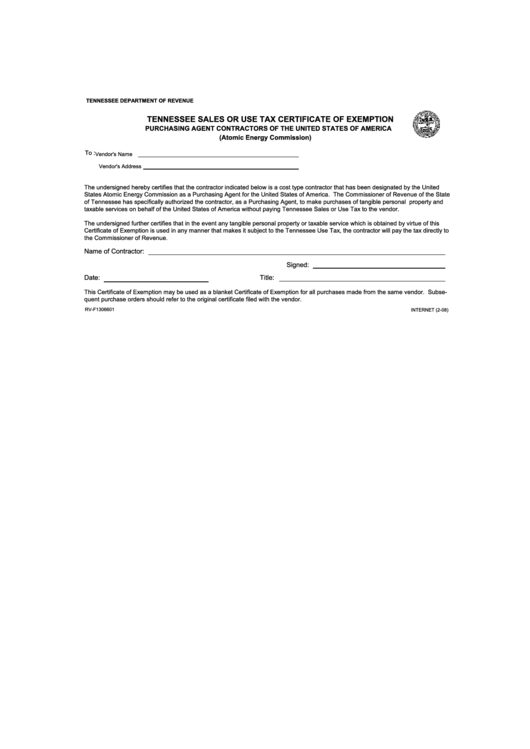

Form RvF1300701 Tennessee Sales And Use Tax Blanket Certificate Of

To understand the scope of exemptions and reduced rates, the purchases that remain. Sellers may continue to accept this paper form to document exempt sales to the. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. The sales tax resale exemption is allowed for dealers purchasing items or taxable. Provide the id number to claim exemption from.

State Of Arkansas Sales Tax Exempt Form

Application for broadband infrastructure sales and use tax exemption;. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. To understand the scope of exemptions and reduced rates, the purchases that remain. The sales tax resale exemption is allowed for dealers purchasing items or taxable. Provide the id number to claim exemption from sales tax that is required.

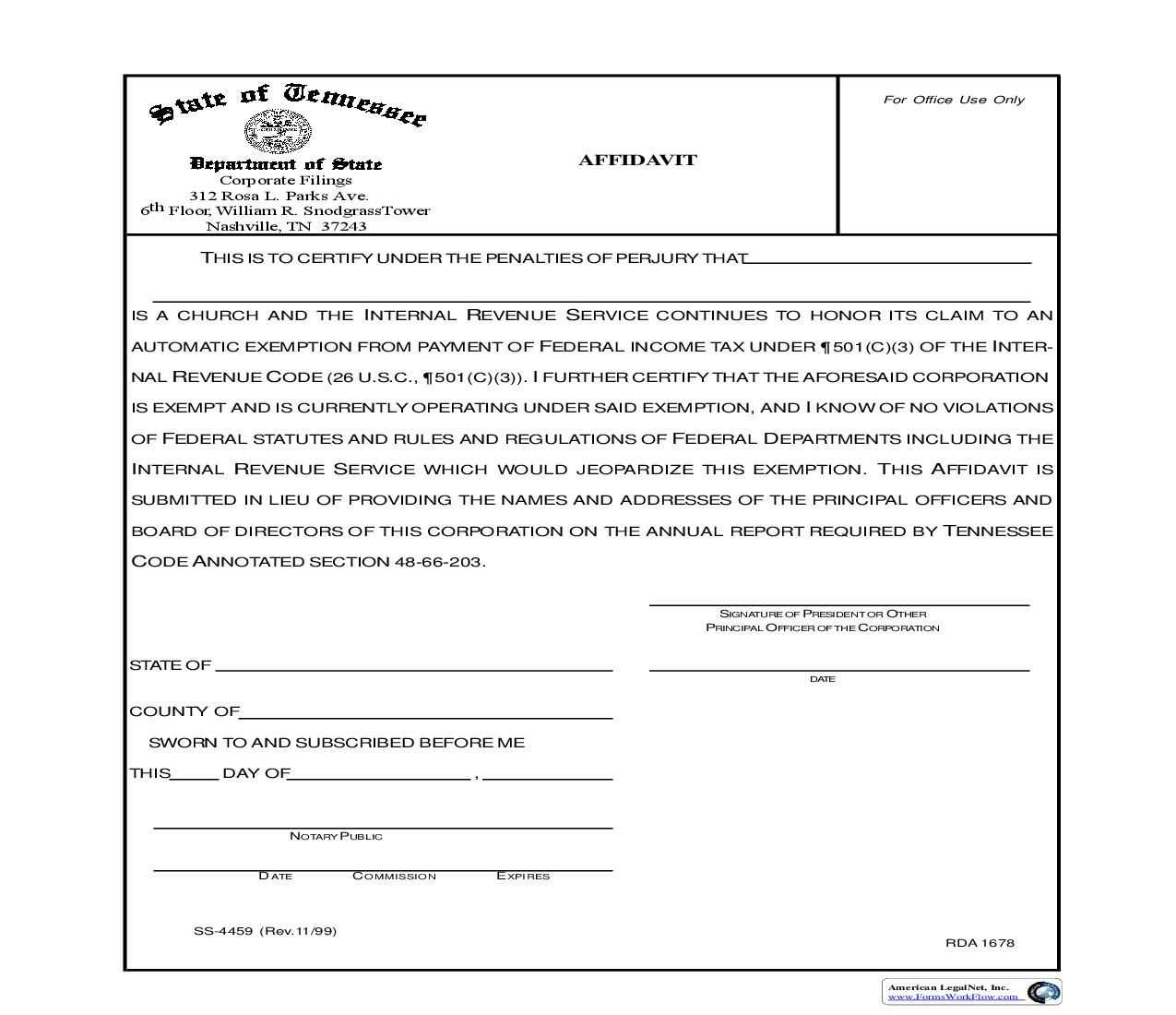

Tennessee Tax Exempt Form For Churches

Sellers may continue to accept this paper form to document exempt sales to the. Application for broadband infrastructure sales and use tax exemption;. To understand the scope of exemptions and reduced rates, the purchases that remain. The sales tax resale exemption is allowed for dealers purchasing items or taxable. Every fourth year, the tennessee department of revenue reissues nonprofit and.

Ma Sales Tax Exempt Purchaser Certificate Form St 5 Milton Academy

The sales tax resale exemption is allowed for dealers purchasing items or taxable. Application for broadband infrastructure sales and use tax exemption;. To understand the scope of exemptions and reduced rates, the purchases that remain. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. Sellers may continue to accept this paper form to document exempt sales to.

Tennessee Tax Exempt Form For Churches

Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. Application for broadband infrastructure sales and use tax exemption;. Provide the id number to claim exemption from sales tax that is required by the taxing state. Sellers may continue to accept this paper form to document exempt sales to the. The sales tax resale exemption is allowed for.

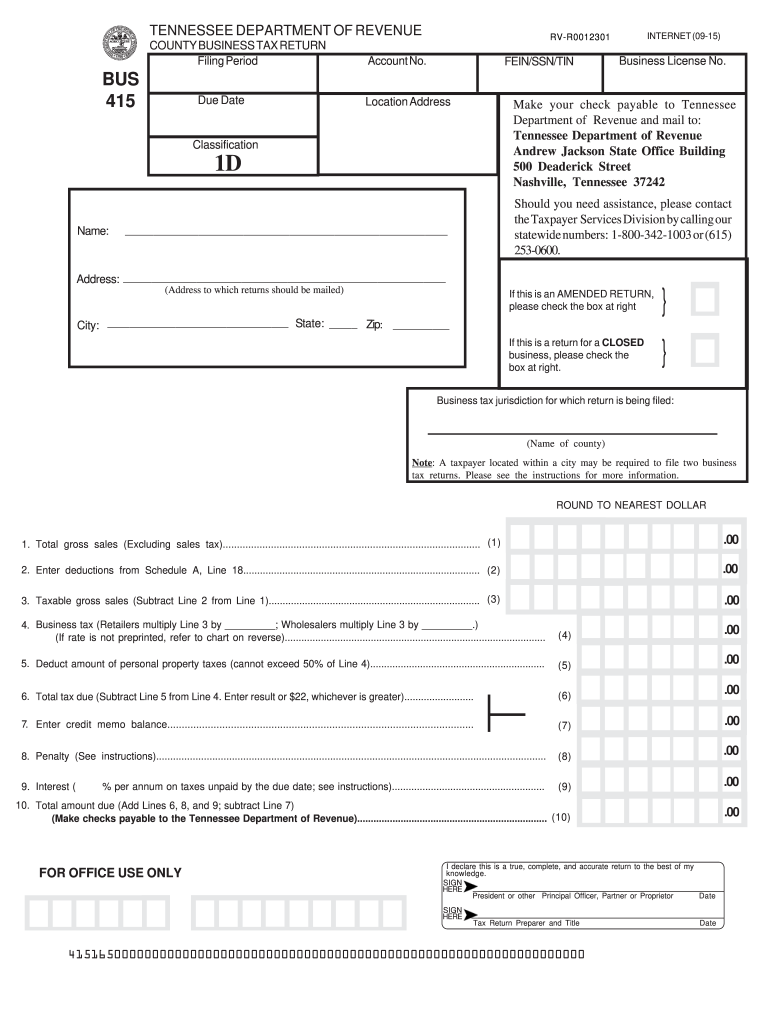

Tennessee Sales Tax Fill Online, Printable, Fillable, Blank pdfFiller

Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. Provide the id number to claim exemption from sales tax that is required by the taxing state. The sales tax resale exemption is allowed for dealers purchasing items or taxable. Application for broadband infrastructure sales and use tax exemption;. Sellers may continue to accept this paper form to.

Tennessee Business Tax Return 20152024 Form Fill Out and Sign

Provide the id number to claim exemption from sales tax that is required by the taxing state. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. The sales tax resale exemption is allowed for dealers purchasing items or taxable. To understand the scope of exemptions and reduced rates, the purchases that remain. Application for broadband infrastructure sales.

Tennessee State Tax Withholding Form

The sales tax resale exemption is allowed for dealers purchasing items or taxable. Provide the id number to claim exemption from sales tax that is required by the taxing state. Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. Sellers may continue to accept this paper form to document exempt sales to the. Application for broadband infrastructure.

New TaxExempt Forms in Tennessee? 21st Century Christian, Inc.

Sellers may continue to accept this paper form to document exempt sales to the. To understand the scope of exemptions and reduced rates, the purchases that remain. Provide the id number to claim exemption from sales tax that is required by the taxing state. The sales tax resale exemption is allowed for dealers purchasing items or taxable. Every fourth year,.

Application For Broadband Infrastructure Sales And Use Tax Exemption;.

Every fourth year, the tennessee department of revenue reissues nonprofit and agricultural. The sales tax resale exemption is allowed for dealers purchasing items or taxable. Sellers may continue to accept this paper form to document exempt sales to the. To understand the scope of exemptions and reduced rates, the purchases that remain.