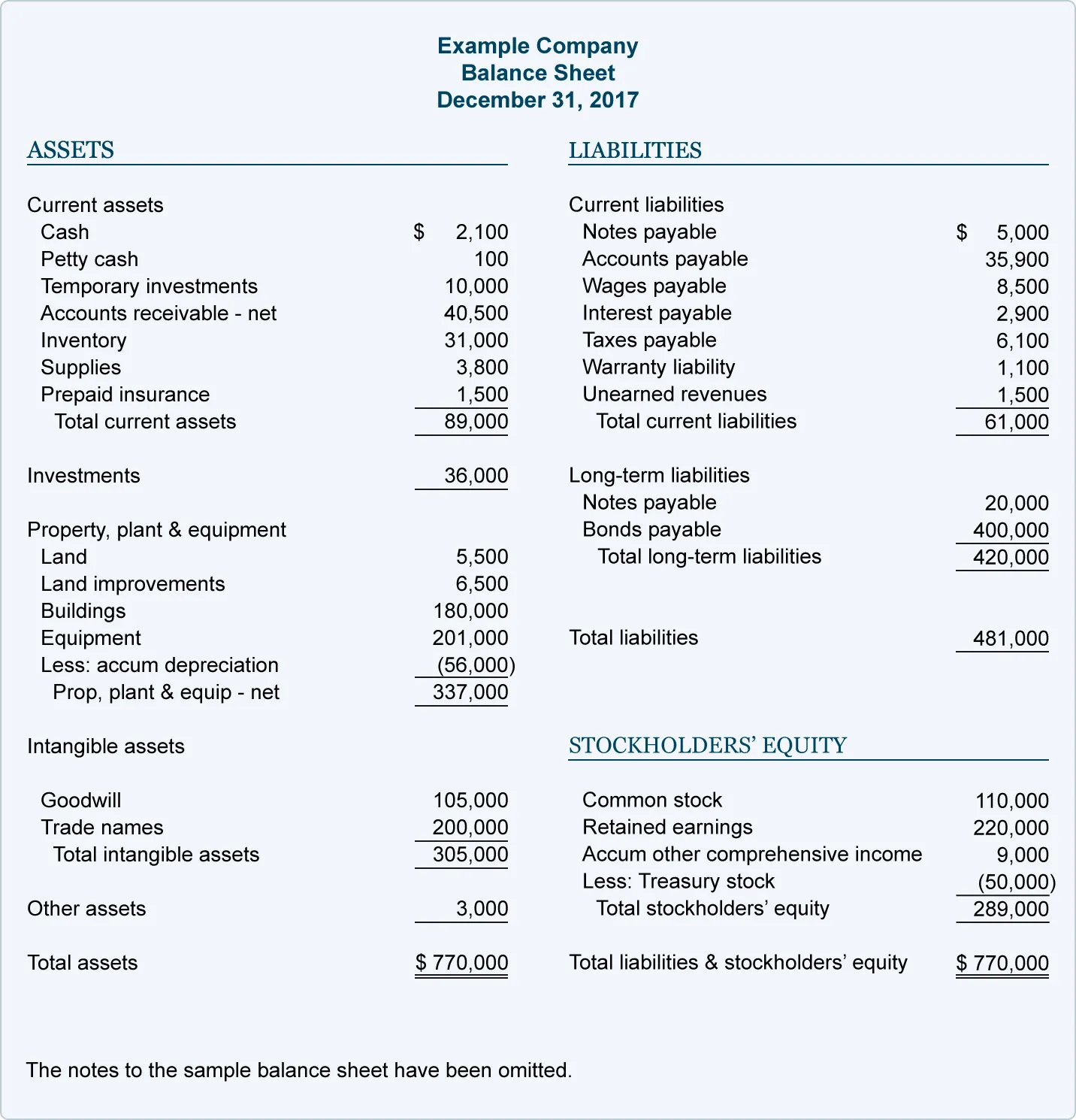

Unearned Revenue On The Balance Sheet - As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. It is not recognized as income until. Unearned revenue represents payments received before a company fulfills its obligations.

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue represents payments received before a company fulfills its obligations. It is not recognized as income until.

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. It is not recognized as income until. Unearned revenue represents payments received before a company fulfills its obligations.

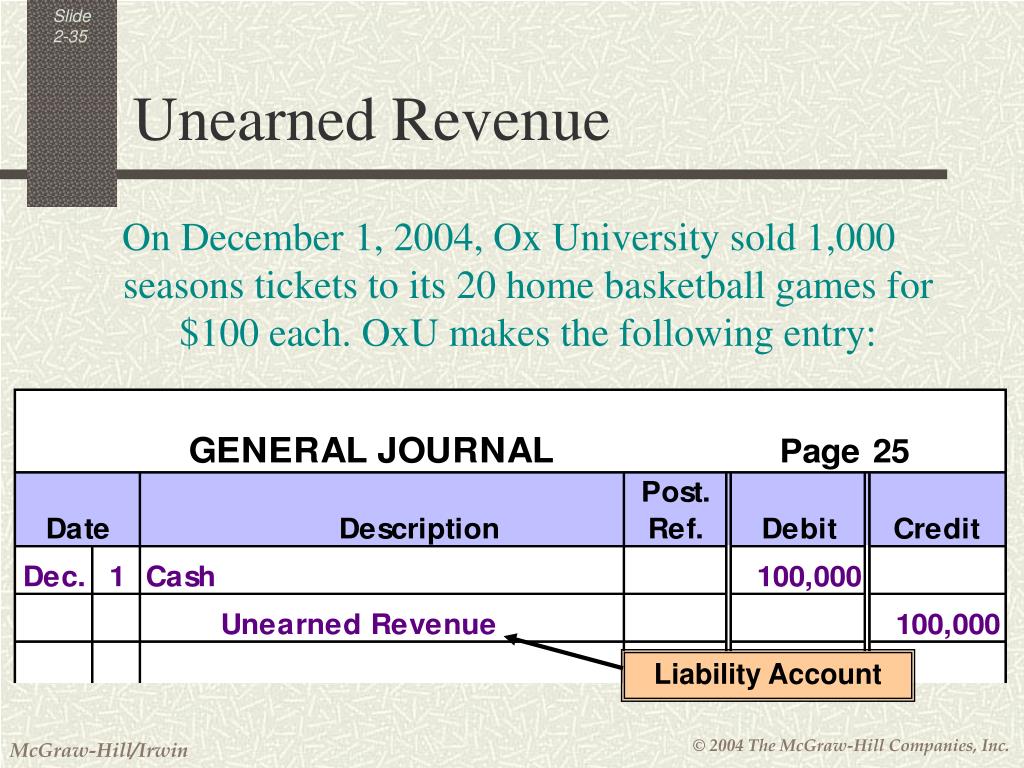

Unearned Revenue Journal Entry Double Entry Bookkeeping

Unearned revenue represents payments received before a company fulfills its obligations. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. It is not recognized as income until.

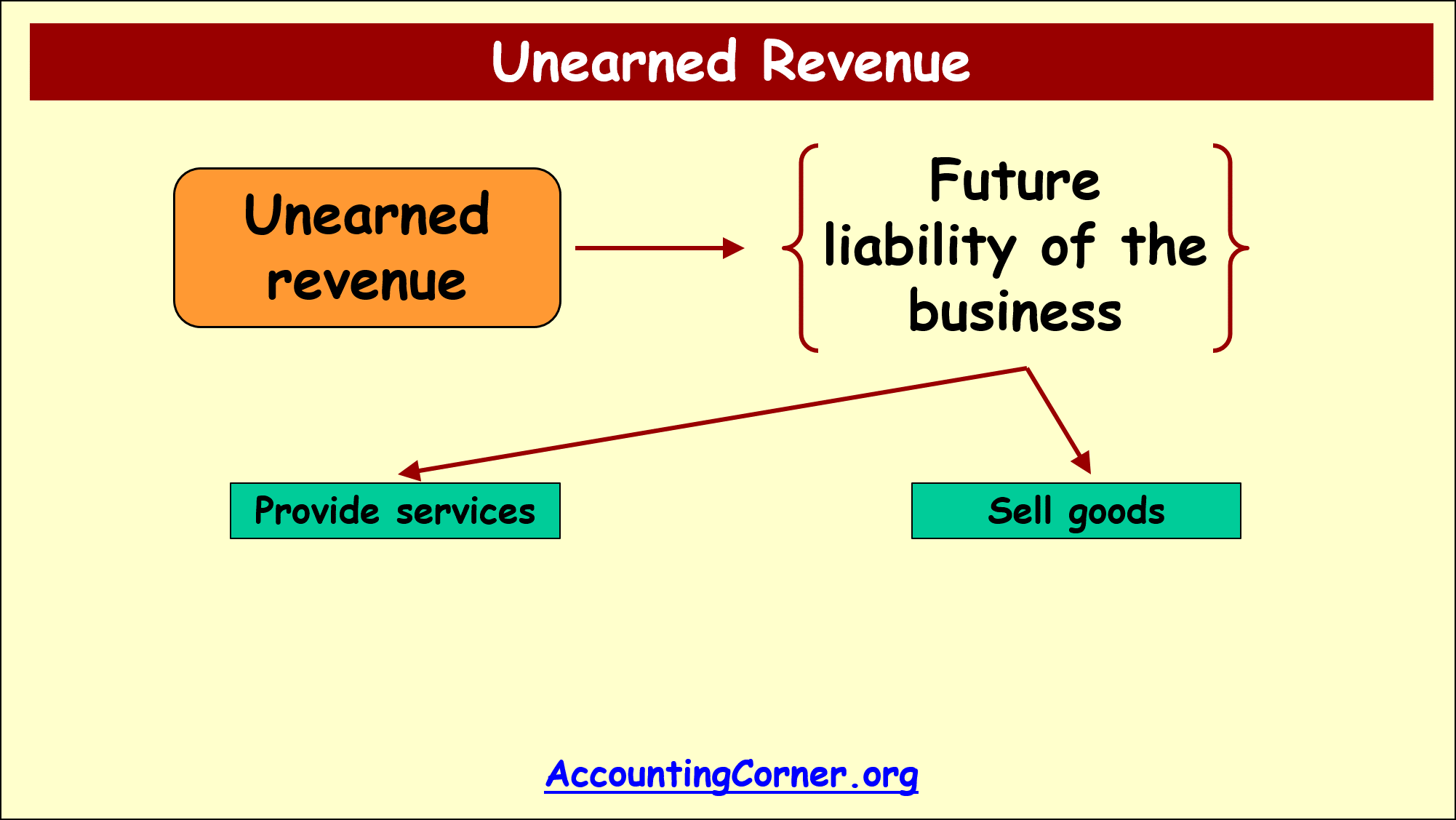

What is Unearned Revenue? QuickBooks Canada Blog

Unearned revenue represents payments received before a company fulfills its obligations. It is not recognized as income until. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

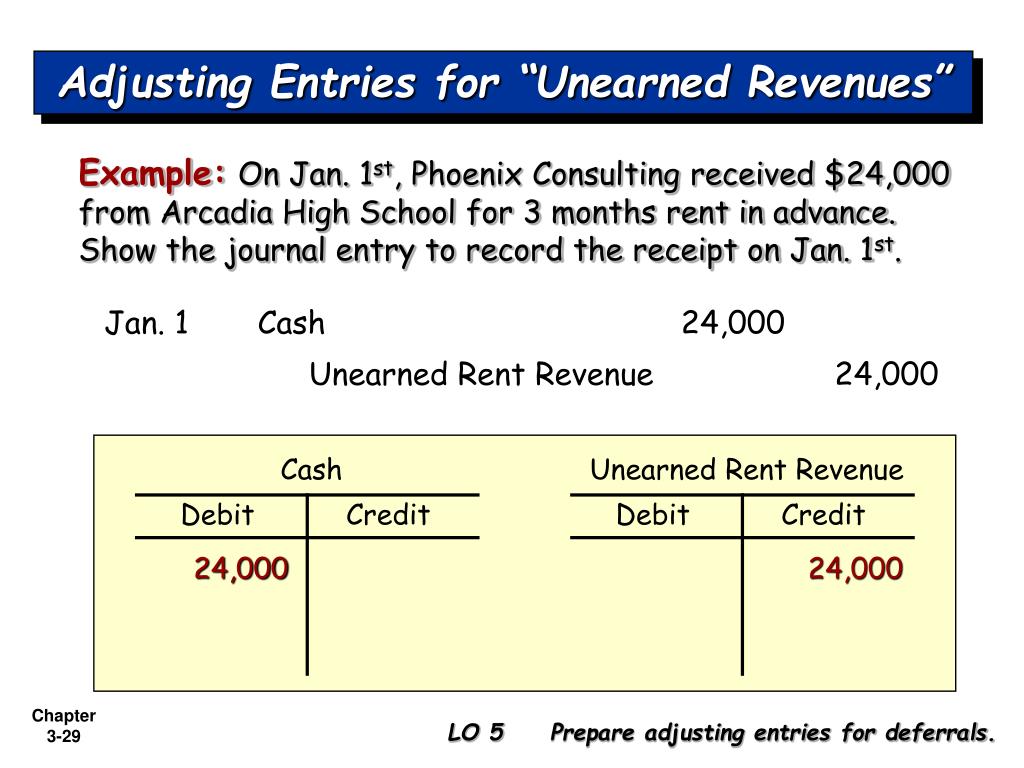

Unearned revenue examples and journal entries Financial

It is not recognized as income until. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue represents payments received before a company fulfills its obligations.

What Is Unearned Revenue? A Definition and Examples for Small Businesses

It is not recognized as income until. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue represents payments received before a company fulfills its obligations.

PPT Chapter 2 PowerPoint Presentation, free download ID6763924

Unearned revenue represents payments received before a company fulfills its obligations. It is not recognized as income until. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

Unearned Revenue Accounting Corner

Unearned revenue represents payments received before a company fulfills its obligations. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. It is not recognized as income until.

PPT CHAPTER 3 PowerPoint Presentation, free download ID934888

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. It is not recognized as income until. Unearned revenue represents payments received before a company fulfills its obligations.

What is Unearned Revenue? QuickBooks Australia

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. Unearned revenue represents payments received before a company fulfills its obligations. It is not recognized as income until.

Unearned Revenue Definition

It is not recognized as income until. Unearned revenue represents payments received before a company fulfills its obligations. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the.

Define Common Liability Accounts Unearned Sales Revenue

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the. It is not recognized as income until. Unearned revenue represents payments received before a company fulfills its obligations.

As A Company Earns The Revenue, It Reduces The Balance In The Unearned Revenue Account (With A Debit) And Increases The.

It is not recognized as income until. Unearned revenue represents payments received before a company fulfills its obligations.

:max_bytes(150000):strip_icc()/Morningstar_-0a37a99b3a0744b6bdf3986e5bdb325b.png)