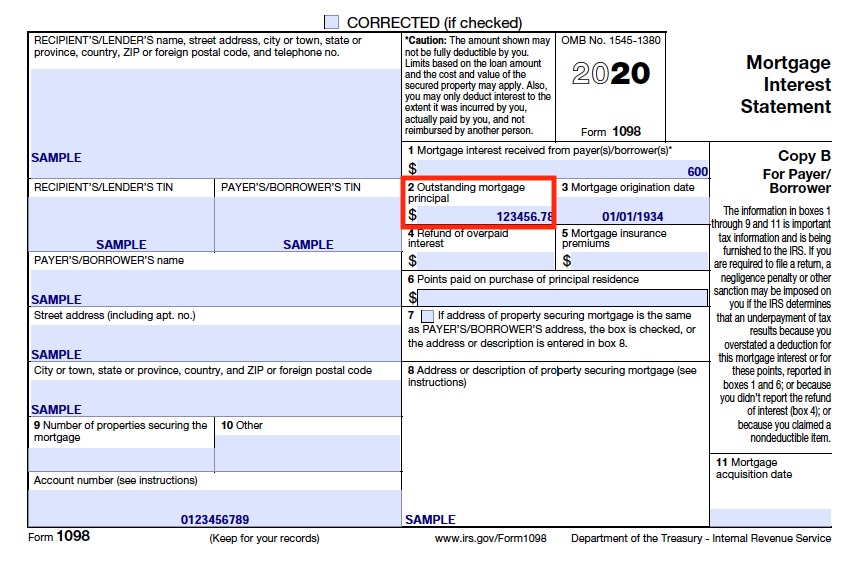

Us Bank 1098 Tax Form - Use form 1098, mortgage interest statement, to report mortgage interest (including points,. Tax form 1098 tells the irs how much mortgage interest you paid last year. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. To learn more, check out our video on how to access your tax documents digitally. Information about form 1098, mortgage interest statement, including recent updates, related.

When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. To learn more, check out our video on how to access your tax documents digitally. Information about form 1098, mortgage interest statement, including recent updates, related. Tax form 1098 tells the irs how much mortgage interest you paid last year. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Use form 1098, mortgage interest statement, to report mortgage interest (including points,.

Tax form 1098 tells the irs how much mortgage interest you paid last year. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. Information about form 1098, mortgage interest statement, including recent updates, related. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. To learn more, check out our video on how to access your tax documents digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,.

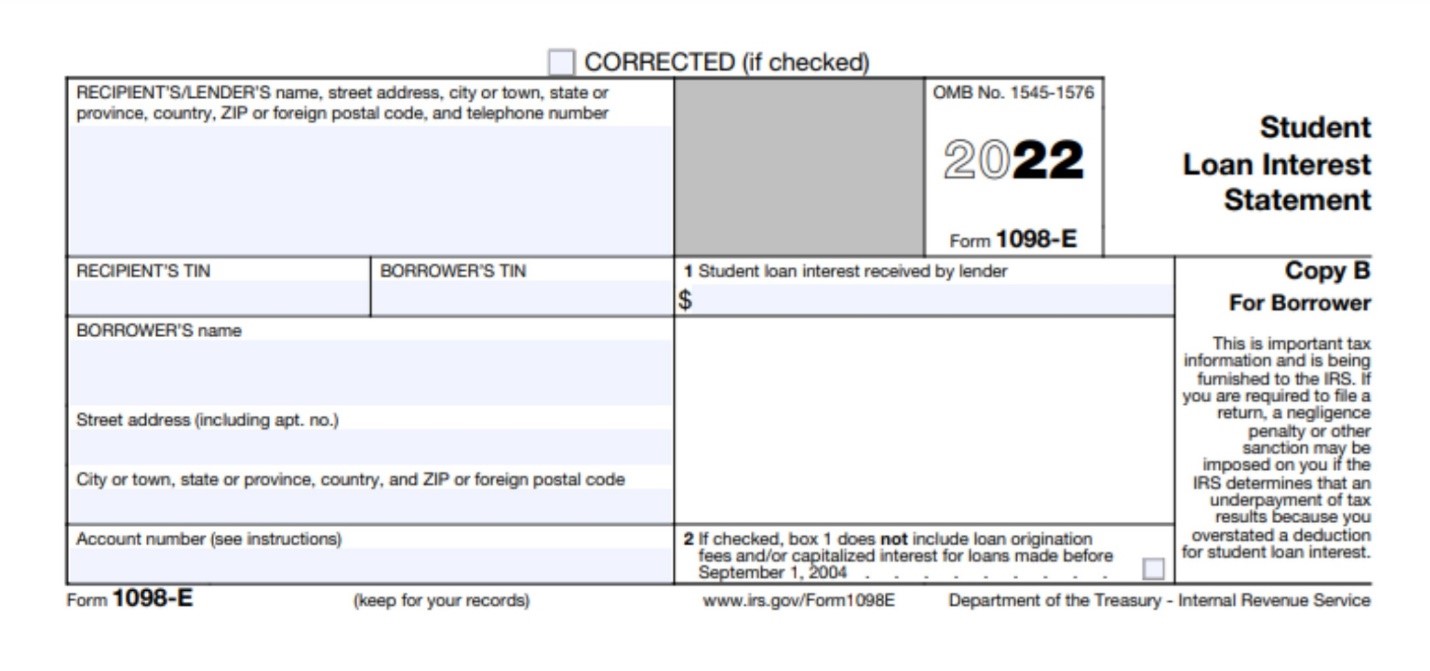

How to Get a Copy of IRS Form 1098E

When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Information about form 1098, mortgage interest statement, including recent updates, related. Tax form 1098 tells the irs how much mortgage interest you paid last year..

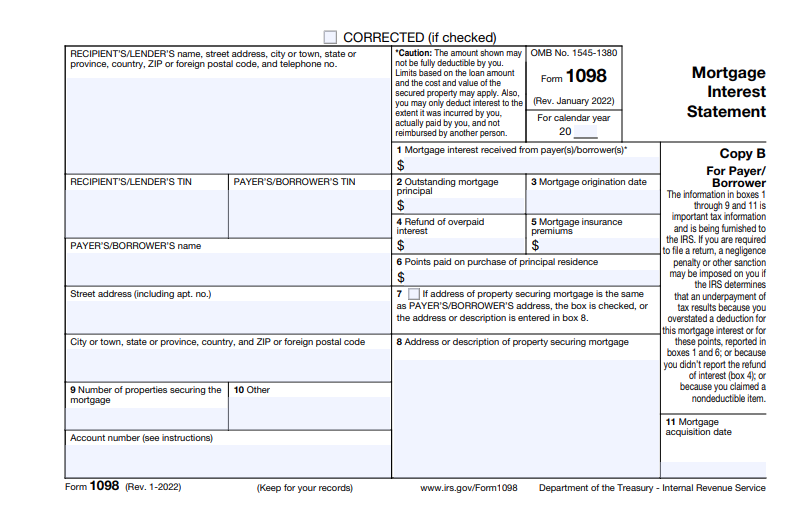

1098 Mortgage Interest Forms United Bank of Union

Information about form 1098, mortgage interest statement, including recent updates, related. To learn more, check out our video on how to access your tax documents digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. The irs requires your financial institution to.

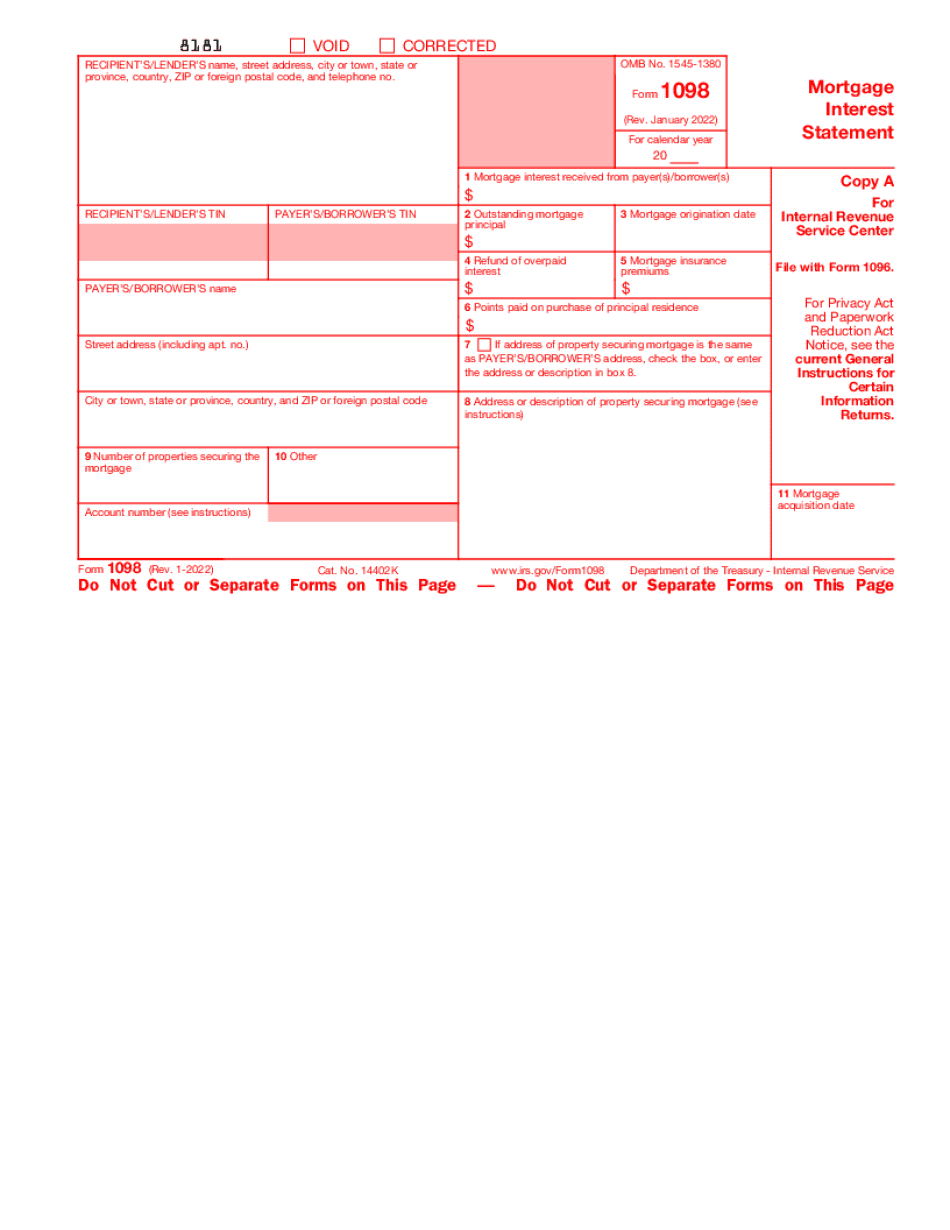

1098 Tax Form 20192024 Fill online, Printable, Fillable Blank

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Information about form 1098, mortgage interest statement, including recent updates, related. Tax form 1098 tells the irs how much mortgage interest you paid last year. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. To learn more,.

Understanding your IRS Form 1098T Student Billing

To learn more, check out our video on how to access your tax documents digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. Information about form 1098, mortgage interest statement, including recent updates, related. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. When tax.

Form 1098T Information Student Portal

Use form 1098, mortgage interest statement, to report mortgage interest (including points,. Tax form 1098 tells the irs how much mortgage interest you paid last year. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Information about form 1098, mortgage interest statement, including recent updates, related. To learn more,.

How to Print and File Tax Form 1098, Mortgage Interest Statement

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. To learn more, check out our video on how to access your tax documents digitally. Tax form 1098 tells the irs how much mortgage interest you paid last year. Information about form 1098, mortgage interest statement, including recent updates, related..

How to Print and File Tax Form 1098, Mortgage Interest Statement

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. To learn more, check out our video on how to access your tax.

Form 1098T 2024 2025

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Information about form 1098, mortgage interest statement, including recent updates, related. To learn more, check out our video on how to access your tax documents digitally. Tax form 1098 tells the irs how much mortgage interest you paid last year..

What is IRS Form 1098?

The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Information about form 1098, mortgage interest statement, including recent updates, related. To learn more, check out our video on how to access your tax documents digitally. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. When tax.

1098 Mortgage Interest Forms United Bank of Union

Use form 1098, mortgage interest statement, to report mortgage interest (including points,. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Tax form 1098 tells the irs how much mortgage interest you paid last year. When tax documents are ready, we'll upload them as pdf files to be reviewed.

Information About Form 1098, Mortgage Interest Statement, Including Recent Updates, Related.

When tax documents are ready, we'll upload them as pdf files to be reviewed digitally. The irs requires your financial institution to send a 1098 tax form only if you paid $600 or more in. Use form 1098, mortgage interest statement, to report mortgage interest (including points,. Tax form 1098 tells the irs how much mortgage interest you paid last year.